40+ How much can i borrow based on my salary

Get Instantly Matched with the Best Personal Loan Option for You. Most home loans require a down payment of at least 3.

Are There Really People Who Only Work 40 Hours A Week Or Less

Generally speaking banks and building societies will lend up to four-and-a-half times your total income.

. As the table below shows if you are on a single income of 75000 a year you could afford to borrow 334846. Halifax recently changed some of the loan-to-income LTI limits applied to its affordability. Based on your current income details you will be able to borrow between.

Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home. Glassdoor reports that the average blogger salary is over 50000 per year based on several anonymously submitted salaries. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

You can use the above calculator to estimate how. The amount of money you spend upfront to purchase a home. In your case your monthly.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Personal Loans 2022 Low Interest Top Lenders Comparison Free Online Offers. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home.

9000000 and 15000000. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. 11 November 2021 1000 pm 4-min read.

Fill in the entry fields. Quick Online From - Simple 3 Minute Form - Get Started Now - Connect with a Lender. How much credit can I borrow based on my salary.

Ad Rates with AutoPay See terms. Assuming you had a 20 deposit that would mean you could. Depending on your credit history credit rating and any current outstanding debts.

Borrowers can typically borrow from 3 to 45 times their annual income. Find out how much you could borrow. According to the financial education platform Economipedia the debt capacity is a standard ranging from 30 to 40 of.

You may qualify for a loan amount ranging from 261881 conservative to 328942 aggressive Show. Ad Low Interest Loans. Your budget is 35 or 14000 and you plan to make a 20 down payment of 2800.

Get Preapproved You May Save On Your Rate. Ad Fill in One Simple Form Get The Best Personal Loan Offers for You. Calculate what you can afford and more.

You need to make 138431 a year to afford a 450k mortgage. Ad We Picked the 10 Best Personal Loan Companies of 2022 for You. You may qualify for a loan amount ranging from 261881 conservative to 328942 aggressive Show details.

Compare Low Interest Personal Loans Up to 50000. We base the income you need on a 450k mortgage on a payment that is 24 of your monthly income. Click Now Apply Online.

Ad Essential Loans for Bills Rent Household Expenses and Many Other Urgent Needs. Lenders like to see a DTI ratio of 40 or less which means if you bring in 5000 of income each month your debt payments should be no more than 2000. A 20 down payment is ideal to lower your monthly payment avoid.

Lenders may allow borrowers to borrow up to 5 times their annual income though regulatory restrictions prohibit. For this reason our calculator uses your. Lets pretend that you make 40K a year.

This mortgage calculation analyses the amount you and your partner earn each year and provides a benchmark amount that you could expect to borrow from a mortgage lender. You dont have a trade-in and you choose a 48. This mortgage calculator will show how much you can afford.

Debt includes any installment. Get an Online Quote in Minutes. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

Check rates in 2 minutes. As a rule of thumb you can borrow up to 4 and a half times your income. Ad Mortgage Rates Have Been on the Decline.

For loans up to 1m at up to 75 LTV meaning a minimum deposit of 25 the. Skip the Bank Save. See if you prequalify for personal loan rates with multiple lenders.

The first step in buying a house is determining your budget.

Salary Slip Format 40 Free Excel And Word Templates Word Template Cover Letter Format Templates

Pin On Letter Of Employment

Pin On Jobs

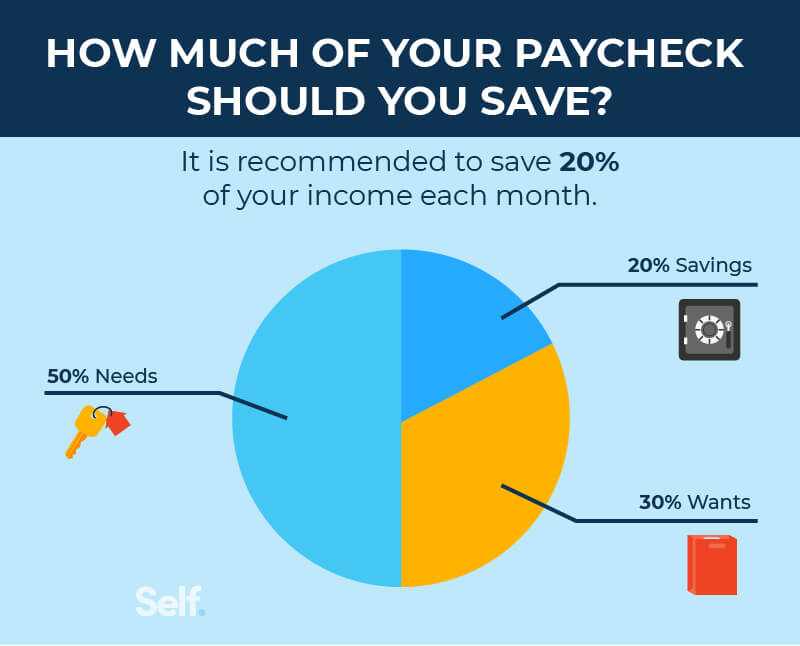

How Much Of Your Paycheck Should You Save Each Month Self Credit Builder

![]()

40 Savings Goal Trackers Savings Spreadsheets Templatearchive

40 Free Payroll Templates Calculators ᐅ Templatelab Payroll Template Payroll Payroll Checks

Salary Vs Hourly Pay Which Should Your Business Be Using

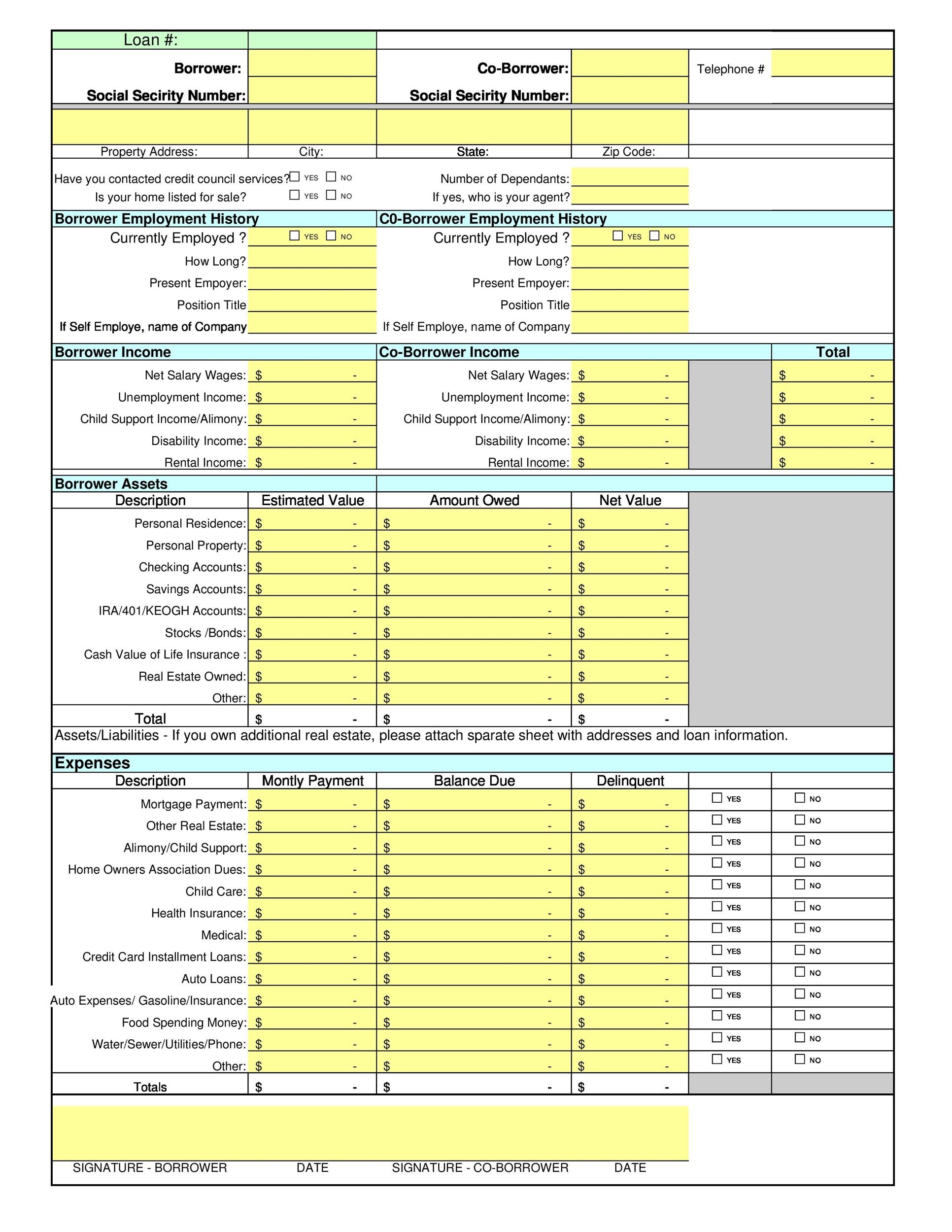

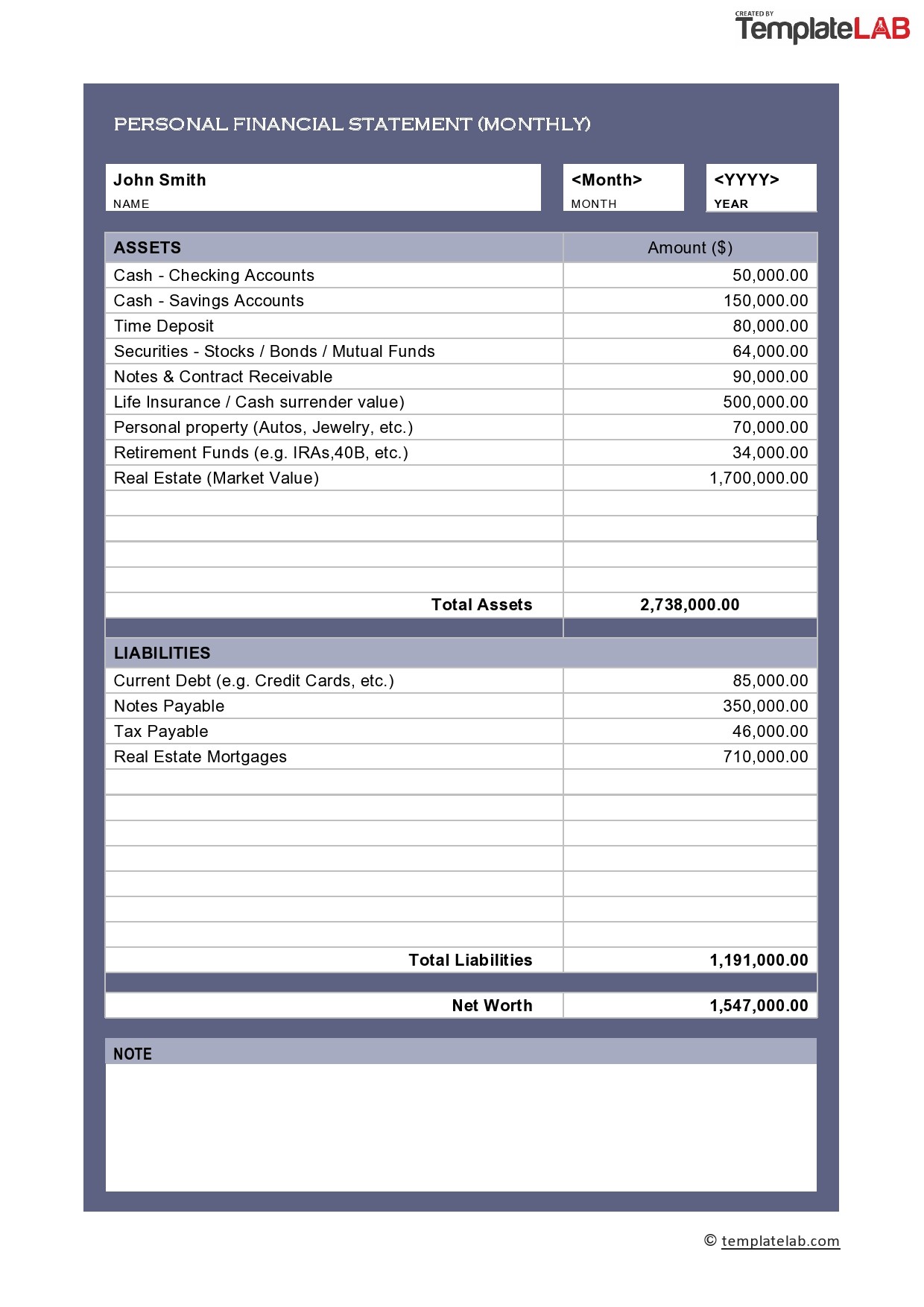

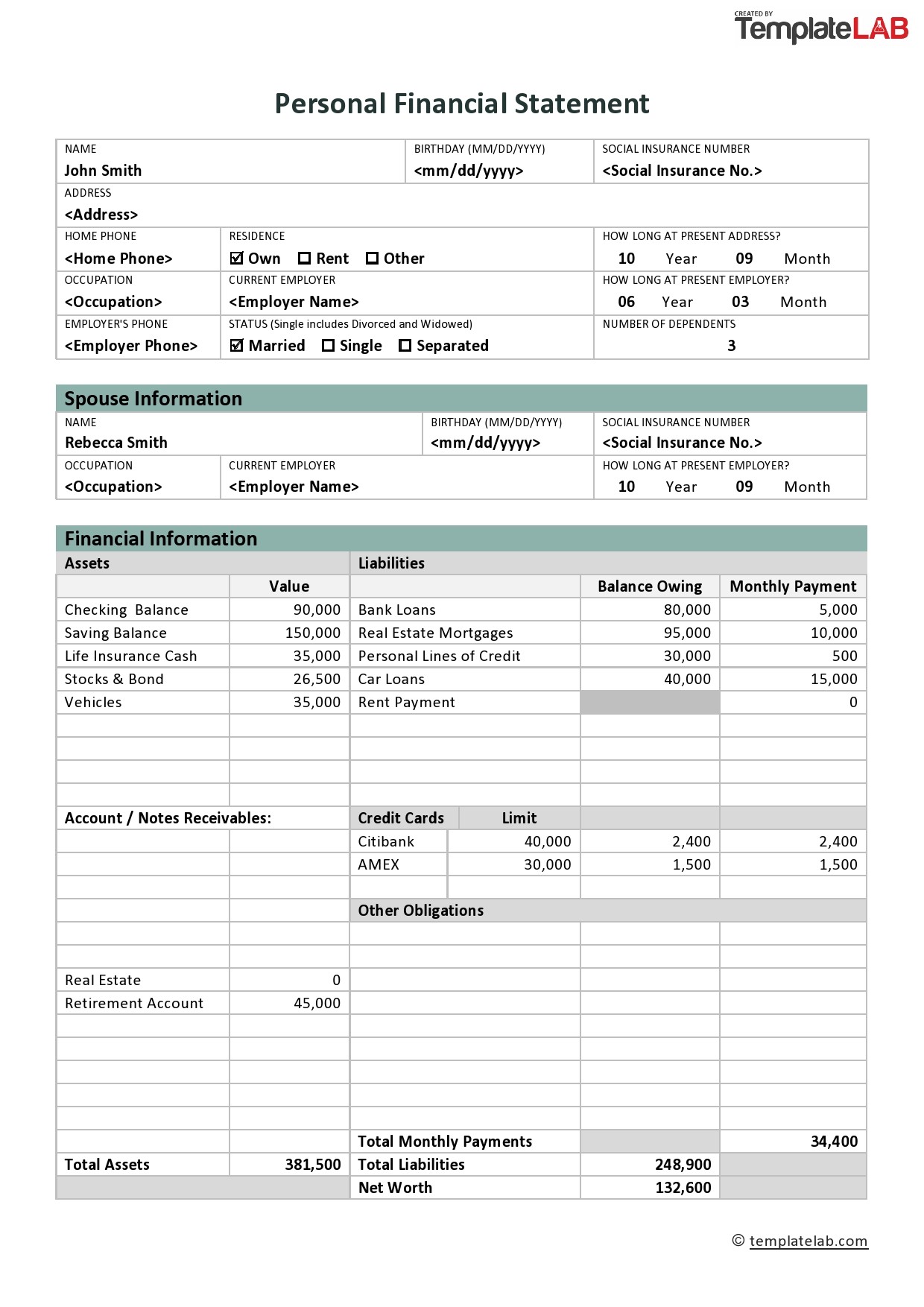

40 Personal Financial Statement Templates Forms ᐅ Templatelab

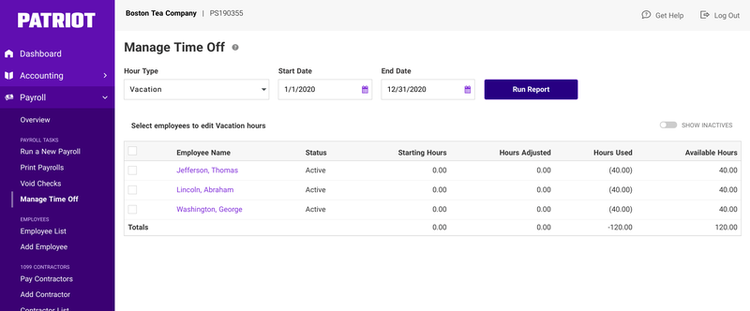

Time Off Requests For Exempt Vs Non Exempt Workology

How Much Should You Spend On That Life And My Finances

How Much Should I Have Saved In My 401k By Age

40 Personal Financial Statement Templates Forms ᐅ Templatelab

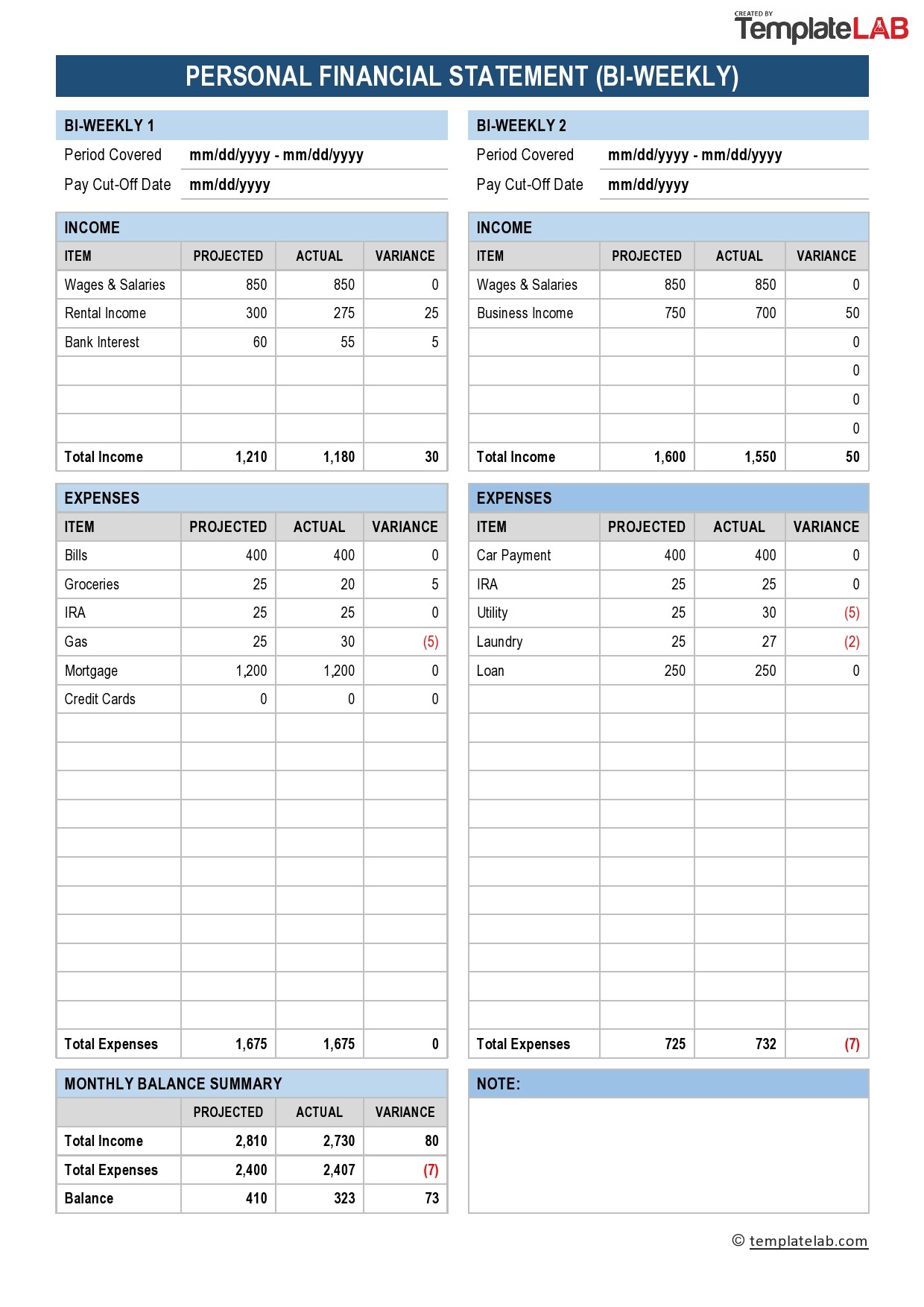

40 Personal Financial Statement Templates Forms ᐅ Templatelab

Can I Get A Housing Loan Of 40 Lakhs As My Salary Is 55 000 Quora

Motivations For Working A Gig Emerald Insight

40 Personal Financial Statement Templates Forms ᐅ Templatelab

Are There Really People Who Only Work 40 Hours A Week Or Less