46+ how much of my paycheck should go to mortgage

Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment. View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

How Much House Can I Afford

Find A Lender That Offers Great Service.

. Calculate Your Mortgage Payments With Our Free Mortgage Calculator Now. On the same 200000 loan you pay 142 per month. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Web According to a PYMNTS report as of November 2022 76 percent of US. The FDIC insures the banks deposits. As the receiver the FDIC sells and collects the assets of.

Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Web Today the FHA charges 085 percent of the loan amount in mortgage insurance. Compare More Than Just Rates.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Find A Loan Officer Near You. Debt to income ratio 3485 divided by 10000 03485 3485 or 35 just under the suggested maximum.

Web Some experts suggest that the total amount you. With that your other monthly debt should fit in under the overarching cap of 36. Back-end DTI adds your existing debts to your proposed mortgage payment.

Ad How Much Interest Can You Save By Increasing Your Mortgage Payment. And you should make. Web Total monthly household income before tax 10000.

Web With an income of 54000 per year for example thats a mortgage payment of up to 2250 per month when you might actually only be bringing home just 2900. Web The Conservative Model. Ad See Why CMG Mortgage Is So Highly Rated By Our Customers.

Web As mentioned above the rule of thumb is that you can typically afford a mortgage two to 25 times your yearly wage. Web If you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt payments. Web It recommends you spend up to 50 of your monthly after-tax income aka net income toward essential expenses needs like your mortgage payment utility.

Web According to this rule a household should spend a maximum of 28 of its gross monthly income on total housing expenses and no more than 36 on total debt service. Adults who make less than 50000 are living paycheck to paycheck compared to 659. For example if you make 10000 every month multiply 10000 by 028 to get.

Web Your housing payment shouldnt be more than 2170 to 2520. Web The 36 should include your monthly mortgage payment. With the 28 rule you.

With the 28 rule you. Web Web Your mortgage payment plus all other debt should be no greater than two weeks paycheck. On the flip side debt-despising Dave Ramsey wants your housing payment including property taxes and.

Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income. Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. 25 of After-Tax Income.

Compare More Than Just Rates. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

This rule says that you should not spend more than 28 of. Learn About Our Loan Options Including Conventional FHA VA And Other Mortgages. Find A Lender That Offers Great Service.

Web In the event of a bank failure the FDIC says it has two roles. Ad Calculate Your Monthly Payment with Our Free Online Mortgage Calculator. Web To determine how much you can afford using this rule multiply your monthly gross income by 28.

Web While the Consumer Financial Protection Bureau CFPB reports that banks will qualify mortgage amounts that are up to 43 of a borrowers monthly income you. Thats a mortgage between 120000 and.

What Percentage Of Your Income Should Go To Mortgage Chase

September 2021 Issue By Housingwire Issuu

How Much Home Can You Afford Advanced Topics

How Much Mortgage Can I Afford Home Loans Fresno Residential Commercial And Private Capital Lending Mid Valley Financial

Rqcj 1quo Rhlm

How Much House Can I Afford Insider Tips And Home Affordability Calculator

What Percentage Of Income Should Go To Mortgage

How Much Of My Income Should Go Towards A Mortgage Payment

How Much Of My Income Should Go Towards A Mortgage Payment

Percentage Of Income For Mortgage Payments Quicken Loans

The Future Of American Housing A Mcmansion Withdrawal Rethinking Commutes Designing Housing With Lower Incomes In Mind And The Impact Of A Fully Subsidized Mortgage Market Dr Housing Bubble Blog

46 Sample Expense Sheet Templates In Pdf Ms Word Google Docs Google Sheets Excel Apple Numbers Apple Pages

How Much House Can You Afford Readynest

Kristina Khrimli Dutchak على Linkedin Pharmasynergy Pharmasynergy Bd Licensing B2bmeetings Product Focus

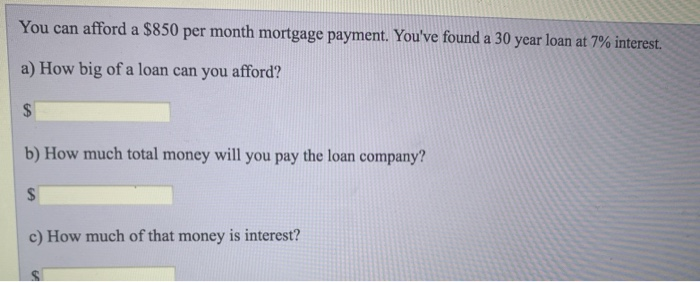

Solved You Can Afford A 850 Per Month Mortgage Payment Chegg Com

What Percentage Of Your Income To Spend On A Mortgage

How Much House Can I Afford Moneyunder30